Washington D.C., May 25, 2022 —

The Securities and Exchange Commission today proposed amendments to rules and reporting forms to promote consistent, comparable and reliable information for investors concerning funds' and advisers' incorporation of environmental, social and governance (ESG) factors. The proposed changes would apply to certain registered investment advisers, advisers exempt from registration, registered investment companies and business development companies.

"I am pleased to support this proposal because, if adopted, it would establish disclosure requirements for funds and advisers that market themselves as having an ESG focus," said SEC Chair Gary Gensler. "ESG encompasses a wide variety of investments and strategies. I think investors should be able to drill down to see what's under the hood of these strategies. This gets to the heart of the SEC's mission to protect investors, allowing them to allocate their capital efficiently and meet their needs."

The proposed amendments seek to categorize certain types of ESG strategies broadly and require funds and advisers to provide more specific disclosures in fund prospectuses, annual reports and adviser brochures based on the ESG strategies they pursue. Funds focused on the consideration of environmental factors generally would be required to disclose the greenhouse gas emissions associated with their portfolio investments. Funds claiming to achieve a specific ESG impact would be required to describe the specific impact(s) they seek to achieve and summarize their progress on achieving those impacts. Funds that use proxy voting or other engagement with issuers as a significant means of implementing their ESG strategy would be required to disclose information regarding their voting of proxies on particular ESG-related voting matters and information concerning their ESG engagement meetings.

Thus, did the SEC, a global leader in using disclosure of material facts to improve the outcomes of financial capitalism, let slip that with ESG, beauty is in the eye of the beholder? From a disciplined standpoint of valuation methodology, ESG is chaos on stilts.

To bring about its desired order in investing markets, the SEC's notice of its proposed regulations is 362 pages long, not quite as long as Qur'an, but likewise a challenge to memorize.

John C. Wilcox, Chairman Emeritus of Morrow Sodali, has written a short commentary titled "Beyond ESG – An Integrated Approach to Governance, Investing and Regulation" that I wanted to share with you:

|

"Time for a Name Change" is the title of a thought-provoking article posted recently on LinkedIn by Stephen Davis, Senior Fellow and Associate Director at Harvard Law School's Program on Corporate Governance.

Davis argues that the acronym "ESG" has outlived its usefulness and needs to be replaced. Writing largely from the viewpoint of investment professionals, he suggests a new term: "360-degree investing." I agree with Davis that a new term to replace ESG is urgently needed. But while "360-degree investing" works for asset managers, it does not work for companies. Even so, Davis's key point makes sense – "ensuring that both investors and companies take account of risks and opportunities that lie outside conventional accounting."

To replace "ESG" for companies, as well as investors, I would propose use of the already familiar term "integrated." One of the dictionary definitions of integrated is: with two or more things combined in order to become more effective. Applied to evaluating business enterprises, an integrated approach could effectively combine environmental, social and governance considerations together with traditional financial and accounting metrics. In addition to inclusiveness, an integrated approach could lead to more realistic regulation aligned with the way businesses are run day-to-day.

Corporate managers must constantly keep their eyes on the road, juggle multiple risks and opportunities, monitor competitors, listen to customers and stakeholders, adjust to market changes and react to ad hoc events. Managing a business enterprise is itself an exercise in integrated thinking and organization.

In support of the proposed integrated approach, here are a few points to be considered:

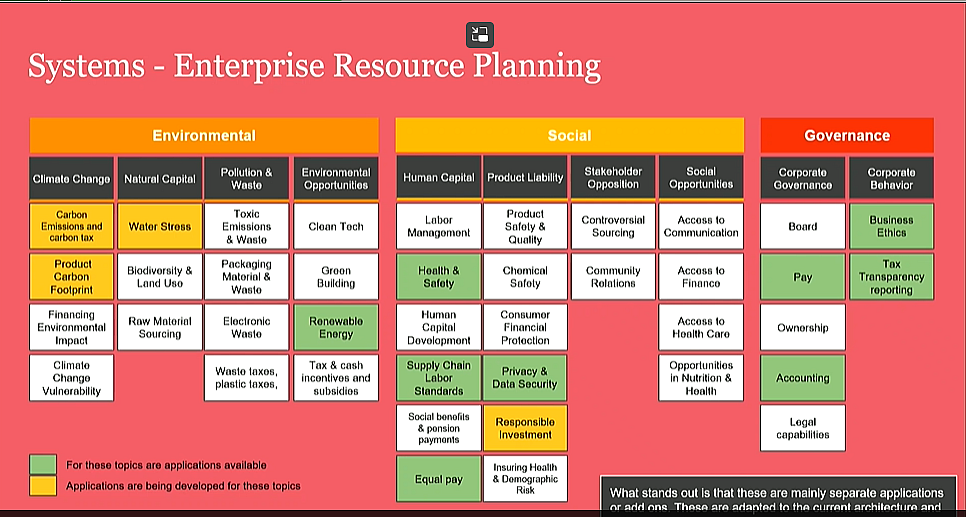

1. We should build on the concept of "integrated reporting" that has already achieved widespread acceptance globally. The International Integrated Reporting Council (IIRC) has long promoted efforts to reduce companies' siloed organizational structures and encourage holistic corporate management and reporting. The IIRC is now a part of the Value Reporting Foundation, which also includes SASB and which through the IFRS Foundation has established the International Sustainability Standards Board (ISSB).

2. We need to eliminate the "zero-sum" thinking that pits ESG against traditional accounting and financial metrics. One of the most important lessons we have learned from the emergence of ESG is that these so-called "intangibles," "externalities" and purportedly "non-financial" factors do in fact have measurable financial impact on companies

|

3. It is no longer appropriate to refer to E, S and G collectively or to treat them as a separate category of issues distinguishable from the traditional business considerations captured in spreadsheets and financial reports.

4. Instead of pitting shareholders against stakeholders, we should recognize that they share a common interest in companies' wellbeing, financial success and sustainability. Indeed, the new generation of millennials and GenX shareholders, together with leading institutional investors, such as BlackRock, are already asserting that ESG issues are integral to their evaluation of the companies they own.

5. We need to put an end to the pushback against ESG that is coming from a variety of sources, including academics, hardline capitalists and politicians. Ideology and politics should not play a lead role when we are considering what is best for businesses, stakeholders and the capital markets.

6. It is time to reexamine the traditional prescriptive, investor-based definition of "materiality." ESG has made us aware that financial materiality needs to be addressed from multiple stakeholder perspectives.

An integrated approach to materiality can best be accomplished by companies internally, using what Uber Technologies in a comment letter to the SEC on climate change describes as an individual "company-specific materiality assessment"1 to supplement legal standards. We need to admit what has always been true: companies, not regulators, ultimately decide what is material to their business.

An integrated approach to materiality would require a more flexible legal definition, including a comply-or-explain option, that could accommodate "company-specific materiality." ESG has had a transformative effect on companies, redefining the corporate social compact, highlighting the materiality of E, S and G issues and introducing important new criteria, such as corporate purpose and culture, human capital management and sustainability

Companies are learning how to factor these issues into their business strategy and how to disclose them. Investors, in turn, are adapting to these demands and looking more deeply into the inner workings of the companies they own.

Standardization and comparability are still needed. Regulators in the EU and the United States are not far behind with new laws and proposed new disclosure requirements.

|

The hope is that global regulators, NGOs and independent standard-setters, in collaboration with the IFRS Foundation and the ISSB, will work together to promulgate disclosure requirements that encourage an integrated approach to management and governance, thereby enabling companies to "tell their own story" to stakeholders and the capital markets.

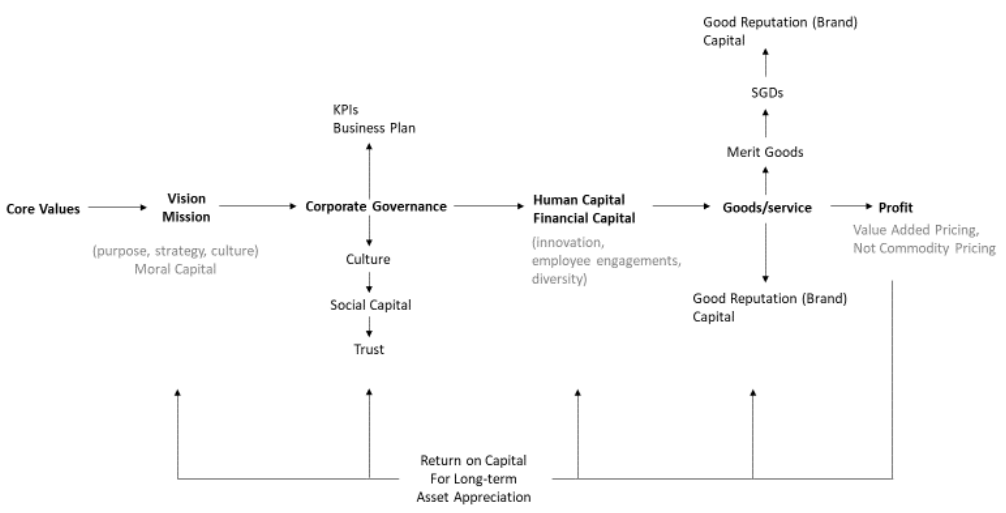

Of course, the Caux Round Table simply proposes to modernize valuation methodology with the application of risk assessments of the management of stakeholders and the addition of human and social capital accounts to balance sheets.

The SEC is also investigating the asset-management arm of Goldman Sachs with respect to its ESG funds. Regulators have concern that marketing ESG labeled funds can be a superficial way to sell financial products, not on the basis of sound risk analysis and realistic valuations, but more to address the status and reputation needs of investors to demonstrate their concern for climate change or diversity in the workplace. Such funds facilitate the flow of capital to firms which take those concerns as their business objectives.

On the other hand, LG Chem believes that its investing in chemical recycling, biodegradables and renewable energy, in battery materials like carbon nanotubes and in new drugs for gout and some types of obesity, will find markets and drive profits. It calls this strategy investing in "ESG values."

Professor Diane Coyle at the University of Cambridge writes that "the movement towards ESG reporting certainly highlights important issues ... But the belief that companies can solve such pressing issues – through pursing ESG standards or otherwise – is deeply flawed. ...At root, demanding that companies use ESG metrics would effectively be asking private companies to legislate social outcomes.

The calls for companies to put social aims at the heart of their activities mean placing small numbers of executives in powerful political, economic and social roles. But business leaders should not be left free to make what are, in fact, important collective decisions. ... Corporate executives should consider the moral aspects of every choice they make. But some of the questions raised about corporate responsibility and ESG reporting do run headlong into political choices." (Foreign Affairs, Jan/February 2022)

Stephen B. Young, Global Executive Director CRT for Moral Capitalism |